Salary ₹50,000? Here’s How Smart Indians Are Saving ₹1 Lakh Tax Legally in 2026 By CA Shiwali | Cashiwali.com Earning ₹50,000 per month (₹6 lakh per year) and still paying unnecessary tax?You’re not alone. In 2026, thousands of salaried Indians overpay tax simply because they don’t plan correctly. The truth is—legal tax saving is possible

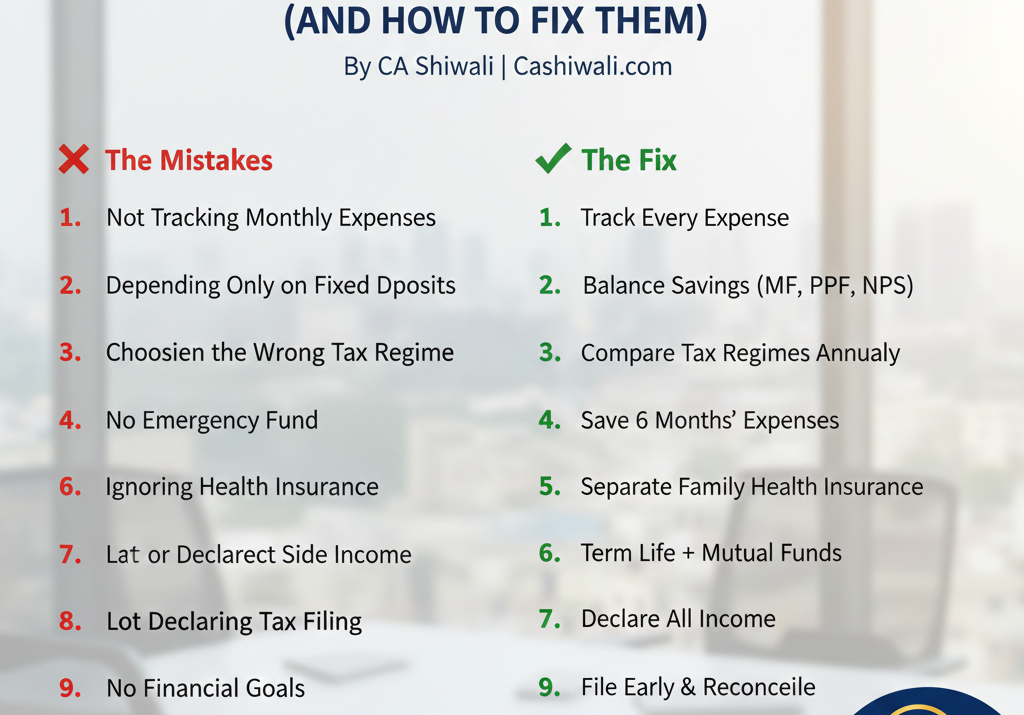

10 Money Mistakes Indian Families Still Make in 2026 (And How to Fix Them) By CA Shiwali | Cashiwali.com Managing money has become more complex in 2026. Despite higher incomes, better apps, and more awareness, many Indian families still struggle financially—not because they earn less, but because they make avoidable money mistakes. As a practicing

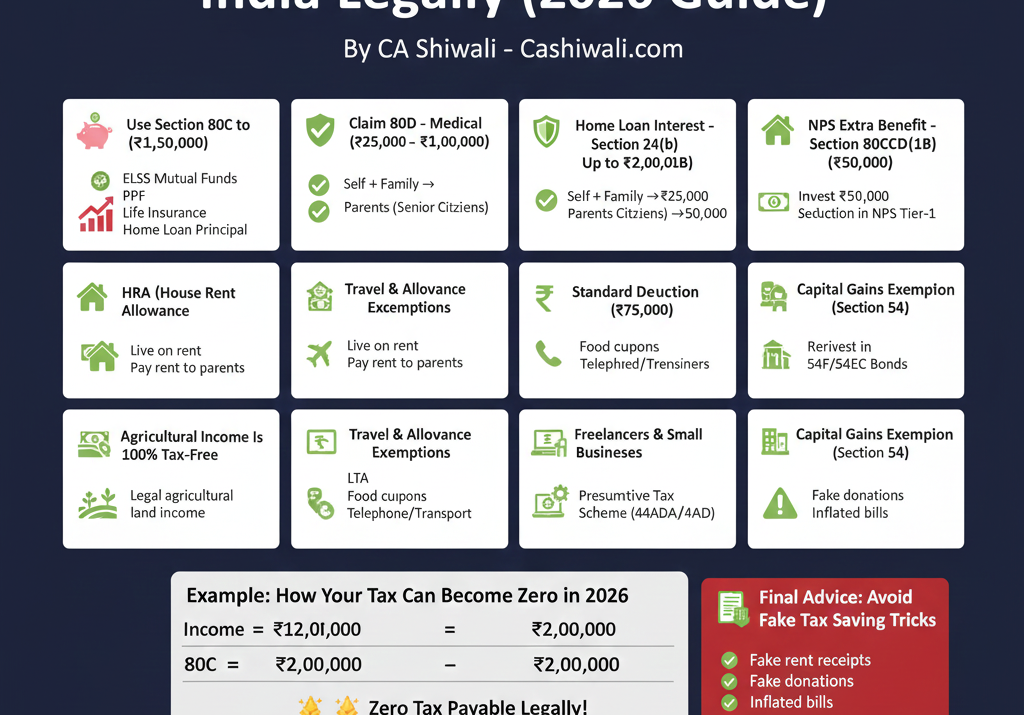

📝 How to Pay Zero Tax in India Legally (2026 Guide) By CA Shiwali – Cashiwali.com Paying zero tax legally in India is absolutely possible—if you understand the Income Tax Act, exemptions, deductions, new rules, and tax-saving investment opportunities. In 2026, with rising income levels, smart tax planning has become essential for salaried individuals, freelancers,

Trust Registration & Compliance in 2026: Updated Rules You Should Know (Complete Guide) Setting up a trust in India is one of the most effective ways to carry out charitable, social, educational, or religious activities. But in 2026, the government has tightened regulations and compliance requirements for trusts, NGOs, and societies. If you’re planning to

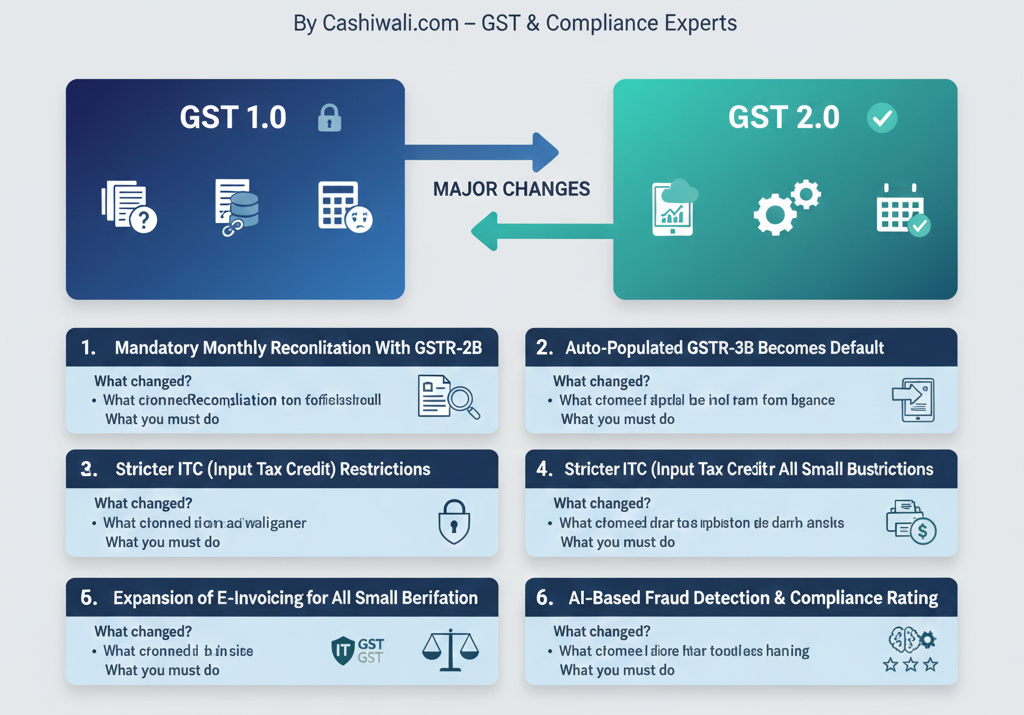

New GST Rules 2025: What Every Small Business Must Do Right Now By Cashiwali.com – GST & Compliance Experts The year 2025 brings major changes to India’s GST framework.The government is moving towards a more transparent, automated, and data-driven compliance system, often referred to as GST 2.0. These new rules directly impact small businesses, MSMEs,

⭐ Article #5: Common GST Mistakes Small Businesses Make — And How to Avoid Them (2025 Guide) By CA Shiwali & Co., Chartered Accountants, New Delhi Running a small business in India means you must comply with GST — but many business owners unknowingly make mistakes that can lead to penalties, notices,