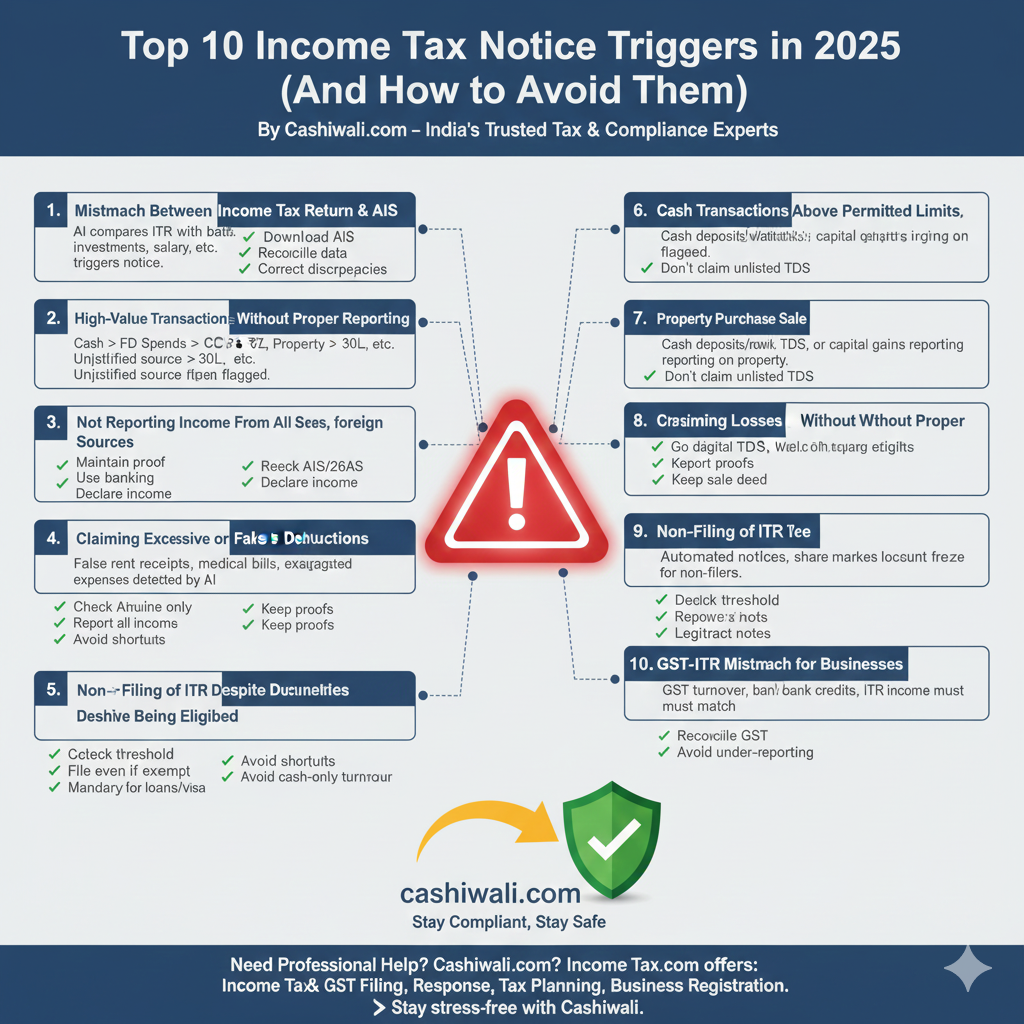

Top 10 Income Tax Notice Triggers in 2025-2026 (And How to Avoid Them)

By Cashiwali.com – India’s Trusted Tax & Compliance Experts

Getting an Income Tax Notice can be stressful — but in most cases, it is completely avoidable.

As India moves towards stricter and more automated tax systems in 2025, the Income Tax Department uses AI-based data matching, AIS, PAN-Aadhaar tracking, and banking insights to detect inconsistencies instantly.

In this article, we explain the top 10 common reasons people receive notices in 2025 and exactly how you can avoid them.

1. Mismatch Between Income Tax Return & AIS

AIS (Annual Information Statement) tracks:

All bank deposits

Credit card spends

Investments

Mutual funds

Salary

Property purchase/sale

TDS details

If your ITR does not match AIS data → notice is triggered automatically.

✔ How to Avoid

Download AIS before filing ITR

Ensure all amounts match your return

Correct any wrong entries through AIS feedback

2. High-Value Transactions Without Proper Reporting

The government tracks high-value transactions such as:

Cash deposits above ₹10 lakh

Credit card spends above ₹2 lakh

Mutual fund investments above ₹2 lakh

Property purchase above ₹30 lakh

Large withdrawals or deposits

If you cannot justify the source → expect a notice.

✔ How to Avoid

Maintain proof for all high-value payments

Use banking channels, avoid unnecessary cash

Declare additional income properly

3. Not Reporting Income From All Sources

Commonly missed incomes:

FD interest

Freelancing income

Side business income

Crypto gains

Rent received

Commission income

Foreign income or remittances

Non-reporting leads to immediate scrutiny.

✔ How to Avoid

Cross-check AIS & Form 26AS

Report all taxable income

Keep digital records

4. Claiming Excessive or Fake Deductions

Examples:

Fake rent receipts

Fake medical bills

Exaggerated business expenses

False 80C/80D investments

AI easily detects fake claims → notice & penalties.

✔ How to Avoid

Claim only genuine deductions

Keep receipts, proofs & bills

Don’t rely on “refund-maximizing shortcuts”

5. Mismatch Between TDS Deducted and TDS Claimed

If your employer, bank, or client shows a different TDS amount than what you claim, the system automatically flags your return.

✔ How to Avoid

Match TDS in Form 26AS before filing

Ask employer or bank to revise if wrong

Never claim TDS that isn’t visible in 26AS

6. Cash Transactions Above Permitted Limits

Cash deposits/withdrawals beyond limits attract ITD attention:

Cash deposits ≥ ₹10 lakh

Cash business sales

Large cash gifts

✔ How to Avoid

Shift to digital mode

Keep proofs for any cash received

Don’t justify business turnover only through cash

7. Property Purchase or Sale Without Proper Reporting

If you buy or sell property:

PAN is mandatory

TDS must be deducted (if required)

Capital gains must be reported

If not handled properly → notice is guaranteed.

✔ How to Avoid

Deduct/collect TDS as applicable

Report capital gains

Keep sale deed, receipts, registry copies

8. Claiming Losses Without Proper Documentation

Examples:

Business losses

Capital losses

Share market losses

If claimed without proof → notice likely.

✔ How to Avoid

Maintain digital books of accounts

Keep contract notes & statements

Claim only legitimate losses

9. Non-Filing of ITR Despite Being Eligible

In 2025, non-filing leads to:

Automated notices

Account freeze (in extreme cases)

Penalties

Even if tax payable is zero, filing may still be mandatory.

✔ How to Avoid

Check filing threshold

File even if income is exempt (in some cases)

Do not skip ITR for loan applications or visa

10. GST–ITR Mismatch for Businesses

If you are a business owner or freelancer:

GST turnover

TDS data

Bank credits

Profit declared in ITR

All should match.

Mismatch = immediate red flag.

✔ How to Avoid

Reconcile GST monthly

Maintain matching turnover in books

Avoid under-reporting income

Final Word

Income Tax notices in 2025 are mostly automated, not personal.

With correct filing, proper documentation, and early planning, notices can be completely avoided.

Need Professional Help Avoiding Notices?

Cashiwali.com helps with:

Income Tax Filing

GST Filing & Reconciliation

Responding to Notices

Tax-saving Planning

Business & Company Registration

👉 Stay safe, compliant, and stress-free — with Cashiwali by your side.