Income Tax Notices Explained: Sections 143(1), 139(9) & 148 (2026)

Author: CA Shiwali Dagar

Updated for: Financial Year 2025–26 | Assessment Year 2026–27

Received an Income Tax Notice? Don’t Panic.

Receiving an Income Tax Notice from the Income Tax Department can be stressful—but most notices are informational or rectifiable if handled correctly and on time.

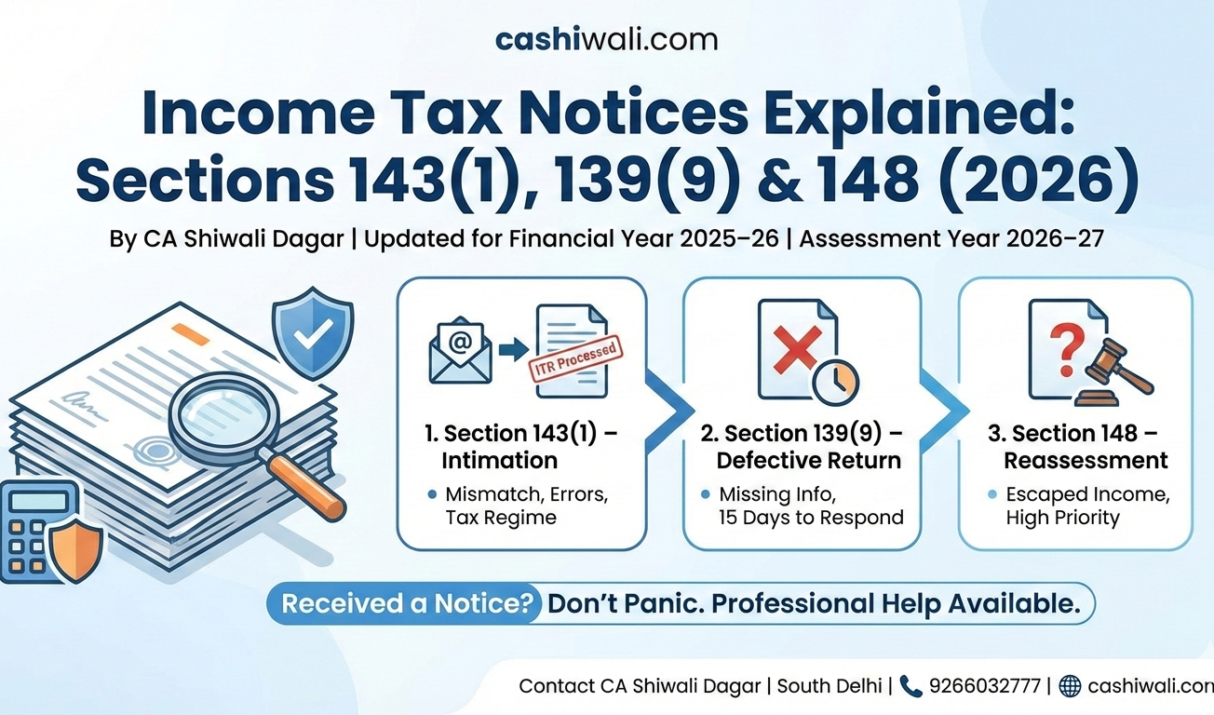

This guide explains the three most common income tax notices received by taxpayers in India:

Section 143(1) – Intimation after return processing

Section 139(9) – Defective return notice

Section 148 – Reassessment notice

Understanding the difference is crucial to avoid unnecessary tax demands, penalties, or litigation.

1️⃣ Income Tax Notice Under Section 143(1)

What is Section 143(1)?

Section 143(1) is an intimation, not a scrutiny. It is issued after your Income Tax Return (ITR) is processed by the CPC (Centralised Processing Centre).

Common Reasons for 143(1) Notice

Mismatch between ITR and Form 26AS / AIS

Incorrect TDS credit claim

Arithmetical errors in return

Incorrect tax regime selection

Late filing fee adjustment under Section 234F

What You Should Do

Compare notice with your filed ITR

Check AIS, TIS, and Form 26AS

File rectification (Section 154) if error is from department side

Pay demand only after verification

⚠️ Ignoring a 143(1) notice can convert a small mismatch into a permanent tax demand.

2️⃣ Income Tax Notice Under Section 139(9)

What is a Section 139(9) Notice?

This notice means your return is considered defective due to missing or incorrect information.

Common Defects Under 139(9)

Balance Sheet & P&L not uploaded for business returns

Incorrect ITR form selection

Missing audit details (where applicable)

Income mismatch with schedules

Mandatory schedules left blank

Time Limit to Respond

15 days from notice date (extendable on request)

Consequences of Non-Response

If not corrected:

Return becomes invalid

Treated as not filed

Loss of carry-forward benefits

Exposure to penalty & interest

3️⃣ Income Tax Notice Under Section 148 (Reassessment)

What is Section 148?

A notice under Section 148 is issued when the Assessing Officer believes that income has escaped assessment.

This is a serious notice and must never be ignored.

Common Triggers for Section 148

High-value transactions

Undisclosed bank accounts

Property or share sale mismatch

Information received from third parties

Incorrect capital gains reporting

New Reassessment Framework (Post 2021)

Prior notice under Section 148A

Opportunity of being heard

Speaking order before reassessment

Why Professional Handling Is Critical

Incorrect reply can escalate litigation

Legal and factual defence is required

Time-bound compliance

Comparison of Income Tax Notices

| Section | Nature | Seriousness | Action Required |

|---|---|---|---|

| 143(1) | Intimation | Low–Medium | Verify & rectify |

| 139(9) | Defective Return | Medium | Correct within deadline |

| 148 | Reassessment | High | CA-assisted response |

How CA Shiwali Dagar Helps with Tax Notices

✔ Detailed notice analysis

✔ AIS / TIS reconciliation

✔ Rectification & reply drafting

✔ Representation before tax authorities

✔ Litigation support when required

All notices are handled with accuracy, documentation discipline, and legal clarity.

Frequently Asked Questions

Is a 143(1) notice bad?

No. It is usually a routine intimation. However, it must be checked carefully.

Can I reply to a tax notice myself?

Simple notices may be handled personally, but professional review is strongly recommended to avoid mistakes.

What happens if I ignore an income tax notice?

Ignoring notices can lead to penalties, interest, best judgment assessment, or recovery proceedings.

Contact CA Shiwali Dagar for Income Tax Notice Help

📍 South Delhi

📞 Phone: 9266032777

🌐 Website: https://cashiwali.com

Final Advice

An income tax notice is not a punishment—it is a request for clarification. Responding correctly and on time protects your finances and peace of mind.

If in doubt, consult a professional.

Related Reads:

Income Tax Notice Assistance

Section 143(1) Intimation Explained

Reassessment Under Section 148 (New Law)