Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

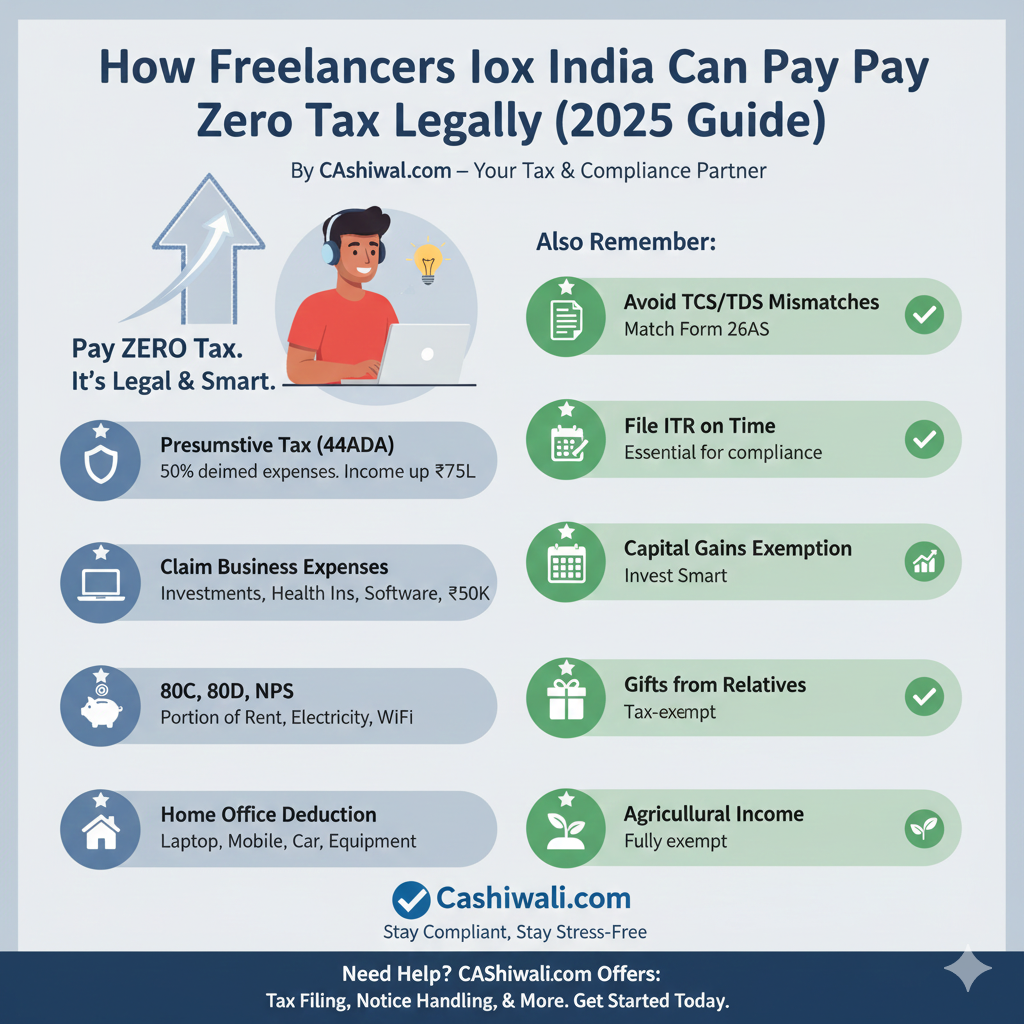

How Freelancers in India Can Pay Zero Tax Legally (2025 Guide)

By Cashiwali.com – Your Tax & Compliance Partner

Freelancing has exploded in India — from content writers and designers to coders, YouTubers, influencers, and consultants.

But most freelancers still don’t know that with the right planning, they can legally bring their income tax close to zero.

Yes, completely legal, approved by the Income Tax Act, and used by top professionals.

In this guide, you’ll learn how to pay minimum or zero tax in India as a freelancer in 2025.

⭐ 1. Use Presumptive Taxation (Section 44ADA) – Pay Almost Zero Tax

This is the biggest tax-saving option for freelancers.

✔ Who can use it?

Any freelancer or professional with annual income up to ₹75 lakh (updated threshold).

✔ How it works

Under 44ADA, the government assumes that only 50% of your income is profit, and the remaining 50% is treated as expenses, even if you don’t have bills.

✔ Example

If you earn ₹10 lakh/year:

-

Taxable income = ₹5 lakh

-

Standard deduction + rebates can reduce tax further

-

Final tax can become zero

No bookkeeping. No expense proof. No hassle.

⭐ 2. Claim Actual Business Expenses (Biggest Advantage for Freelancers)

If you don’t opt for presumptive taxation, you can still reduce tax by claiming real business expenses such as:

-

Laptop, desktop, phone

-

Internet bills

-

Co-working space rent

-

Travel for client meetings

-

Marketing & ads

-

Software subscriptions

-

Office chair, desk, lighting

-

Website & domain hosting

-

Freelance platform fees

You are taxed only on net profit = Income – Expenses.

✔ Result:

A freelancer earning ₹12–15 lakh can bring taxable income down to ₹3–5 lakh.

After deductions → tax becomes zero.

⭐ 3. Use Section 80C to Save ₹1,50,000

Freelancers can claim all the tax-saving investments salaried people do:

-

PPF

-

ELSS mutual funds

-

Life insurance

-

5-year tax-saving FD

-

Principal repayment of home loan

Total deduction: ₹1,50,000.

⭐ 4. Health Insurance Deduction – Section 80D

Freelancers with no corporate benefits should claim this:

-

₹25,000 for self + family

-

₹50,000 for parents

Total possible deduction: ₹75,000

⭐ 5. Home Office Deduction (Most Freelancers Forget This!)

If you work from home, you can claim:

-

Portion of rent

-

Electricity used for work

-

Home WiFi

-

Furniture used for workspace

Even 10–20% home rent can help reduce taxes.

⭐ 6. Depreciation Benefits

You can claim depreciation on:

-

Laptop

-

Camera

-

Mobile

-

Office equipment

-

Car (if used for business)

This reduces taxable profit significantly.

⭐ 7. Use NPS (Section 80CCD(1B)) – Extra ₹50,000 Deduction

Apart from 80C, freelancers get another ₹50,000 deduction using NPS.

This alone can take tax from small income brackets to almost zero.

⭐ 8. Avoid TCS & TDS Mismatches

Freelancers receiving payments via:

-

Upwork

-

Fiverr

-

YouTube

-

Affiliate platforms

-

Foreign clients

… must make sure their Form 26AS matches their income.

Mismatch triggers notices.

⭐ 9. File ITR on Time to Avoid Automatic Scrutiny

Freelancers often skip tax filing.

In 2025, skipping ITR leads to:

-

AI-based notices

-

Blocking of refunds

-

Scrutiny under high-value transaction rule

Always file before the due date.

⭐ 10. Want Zero Tax? Combine These Strategies

Here’s a winning combination:

-

Choose Presumptive Taxation (44ADA)

-

File all business expenses

-

Use 80C + 80D + NPS deductions

-

Home office benefits

-

Depreciation on laptop/mobile

-

Standard deduction (where applicable)

Using this structure, many freelancers earning up to ₹12–18 lakh per year legally reduce final tax to zero.

🎯 Final Summary

Freelancers in India can legally reduce their tax to zero by:

✔ Using presumptive taxation

✔ Claiming all business expenses

✔ Utilizing 80C, 80D, and NPS deductions

✔ Avoiding AIS/TDS mismatches

✔ Filing ITR properly

With the right tax planning, freelancers save money, stay compliant, and avoid notices.

⭐ Need Help Paying Zero Tax Legally?

Cashiwali.com helps freelancers with:

-

Tax planning

-

Income tax filing

-

GST filing

-

Handling notices

-

Business registration

-

Accounting & bookkeeping

👉 Start saving taxes the smart way with Cashiwali.com