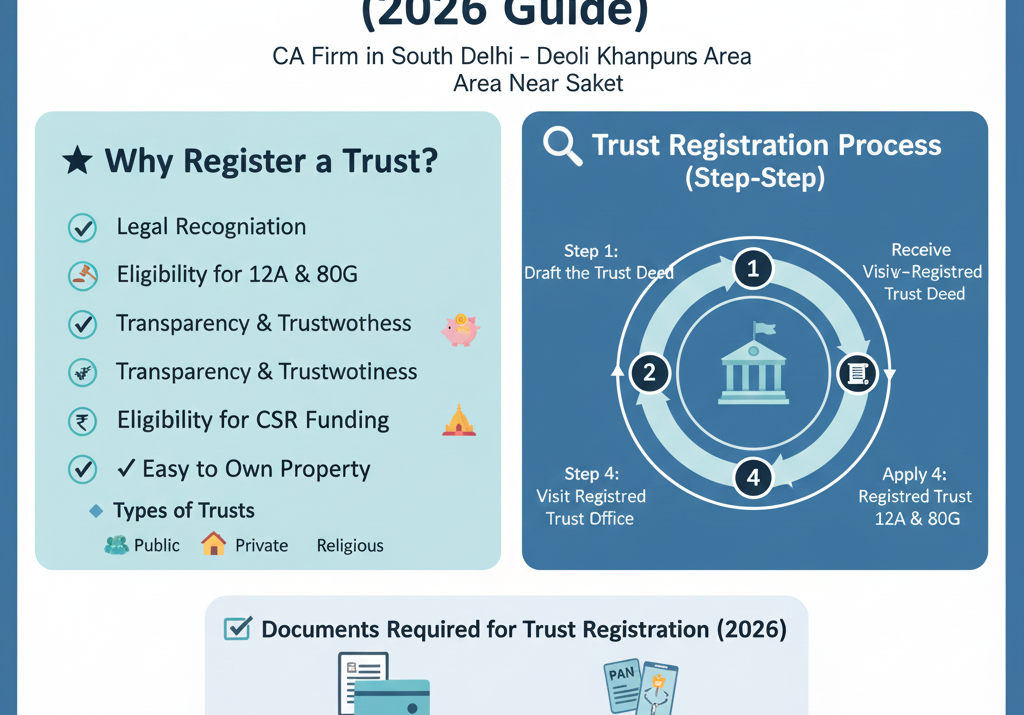

Trust Registration in India: Benefits, Process & Documents (2026 Guide) In India, thousands of people start charitable, educational, and religious activities every year. But many don’t know that to run these activities legally and receive donations transparently, you must register a Trust. This 2026 guide explains what a Trust is, why registration matters, documents needed,

Company Registration Made Easy: A Beginner’s Guide for Small Business Owners in South Delhi (2025) Starting a business is exciting, but registering a company can feel confusing for many first-time entrepreneurs. The good news? The process has become much simpler, faster, and fully online. This guide explains everything you need to know about company registration,

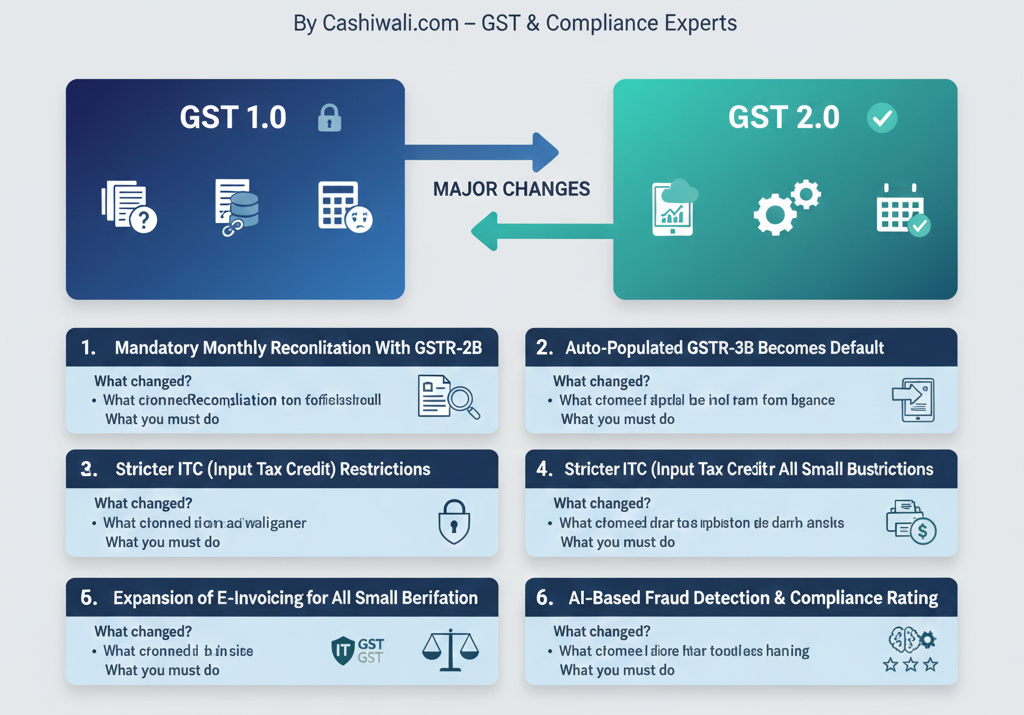

New GST Rules 2025: What Every Small Business Must Do Right Now By Cashiwali.com – GST & Compliance Experts The year 2025 brings major changes to India’s GST framework.The government is moving towards a more transparent, automated, and data-driven compliance system, often referred to as GST 2.0. These new rules directly impact small businesses, MSMEs,

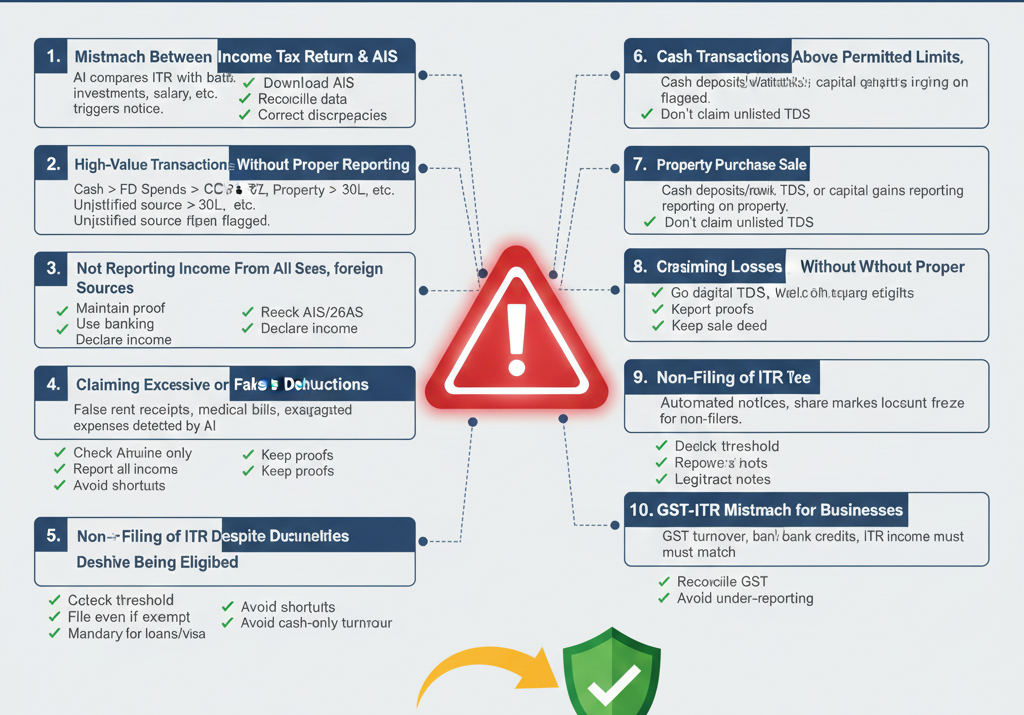

Top 10 Income Tax Notice Triggers in 2025-2026 (And How to Avoid Them) By Cashiwali.com – India’s Trusted Tax & Compliance Experts Getting an Income Tax Notice can be stressful — but in most cases, it is completely avoidable.As India moves towards stricter and more automated tax systems in 2025, the Income Tax Department uses

How to Adapt From GST 1.0 to GST 2.0: What Changed & What Businesses Must Do in 2025 India’s GST system is evolving. After years of using GST 1.0, the government has begun rolling out features of a more advanced, technology-driven system — popularly referred to as GST 2.0. GST 2.0 is not a new

How to Pay Zero Tax in India Legally (Complete Guide for 2025) By Cashiwali.com – India’s Trusted Tax & Compliance Partner Paying taxes is a responsibility, but paying more tax than required is not!Most Indians don’t know that the Income Tax Act provides several legal ways to reduce taxable income — many of which