🧾 Income Tax Consultant Near Saket, Deoli & Khanpur – What Services You Really Need (2026 Guide) By CA Shiwali | Cashiwali.com Searching for a reliable income tax consultant near Saket, Deoli, or Khanpur?In 2026, tax laws are stricter, notices are more common, and mistakes can be costly. Whether you are a salaried employee, business

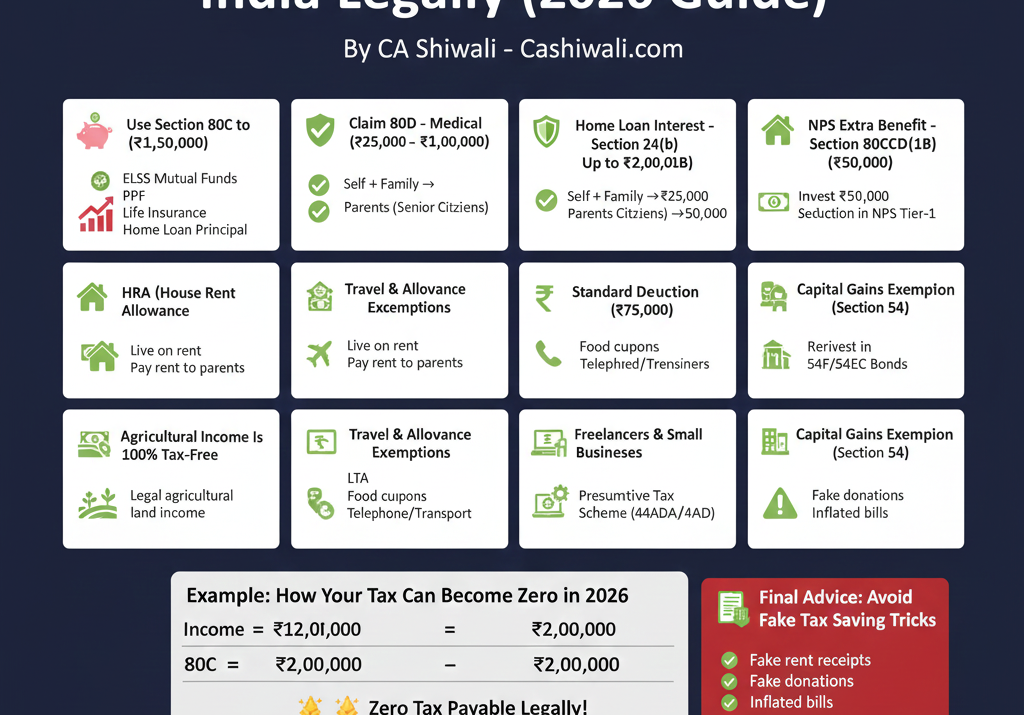

📝 How to Pay Zero Tax in India Legally (2026 Guide) By CA Shiwali – Cashiwali.com Paying zero tax legally in India is absolutely possible—if you understand the Income Tax Act, exemptions, deductions, new rules, and tax-saving investment opportunities. In 2026, with rising income levels, smart tax planning has become essential for salaried individuals, freelancers,

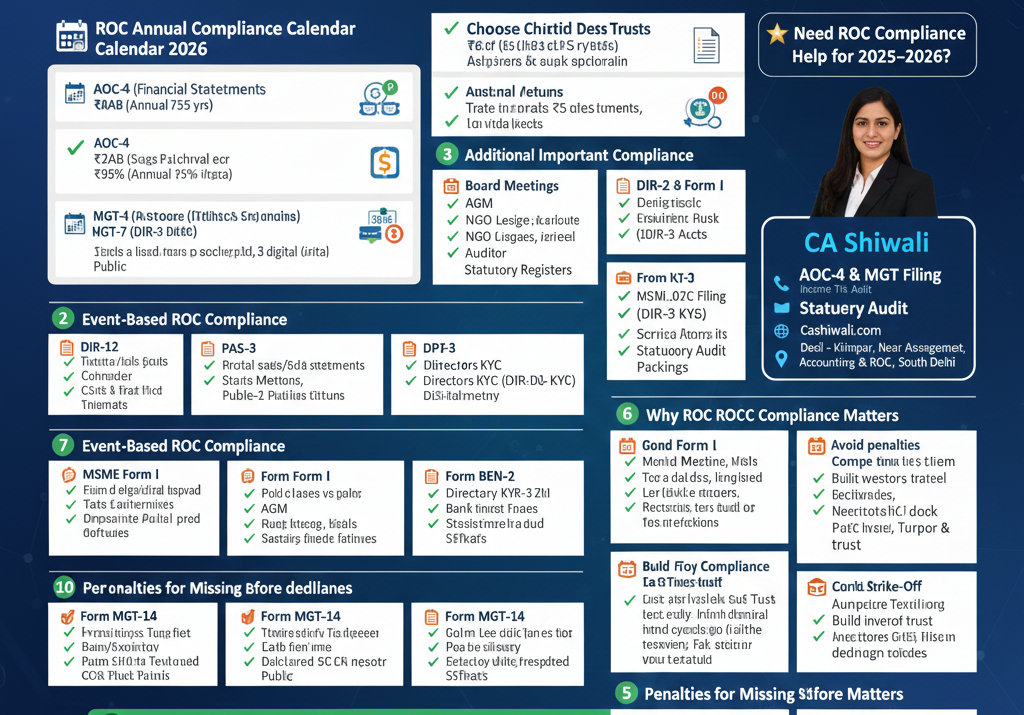

1️⃣ ROC Annual Compliance Calendar 2026 (For All Pvt Ltd Companies) Every company must file two primary annual forms: ✔ AOC-4 (Financial Statements) Due Date: 30 October 2026Filed within 30 days of AGM. Must include: Balance Sheet Profit & Loss Cash Flow Statement Notes to Accounts Auditor’s Report Director’s Report ✔ MGT-7 (Annual Return) Due

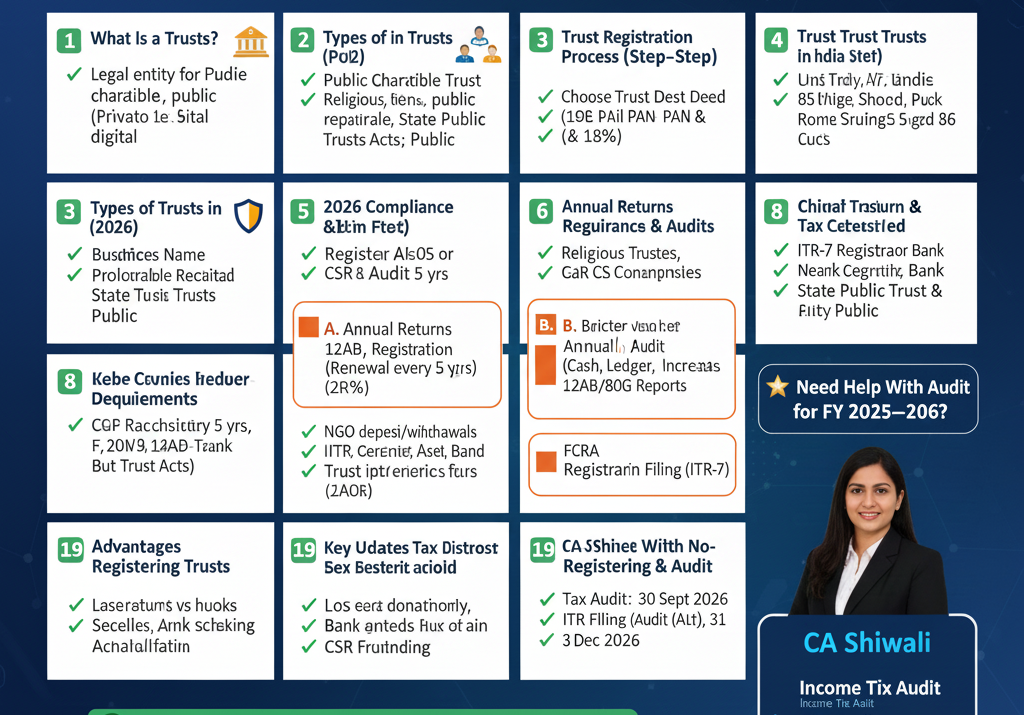

Trust Registration & Compliance in 2026: Updated Rules You Should Know (Complete Guide) Setting up a trust in India is one of the most effective ways to carry out charitable, social, educational, or religious activities. But in 2026, the government has tightened regulations and compliance requirements for trusts, NGOs, and societies. If you’re planning to

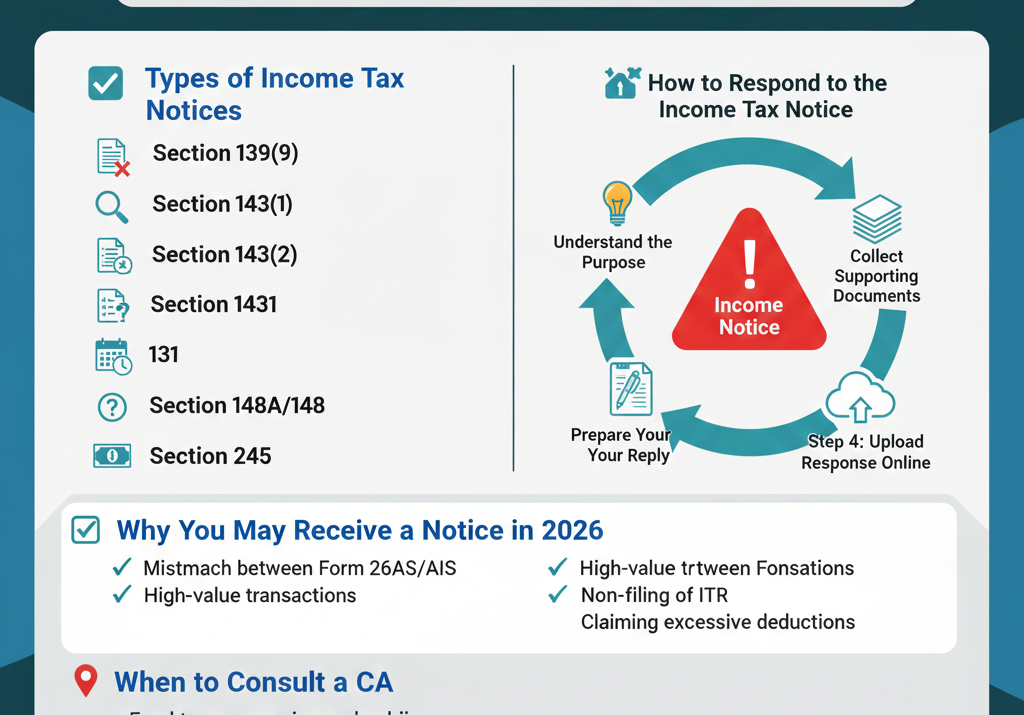

⭐ How to Respond to an Income Tax Notice in India — A Complete 2026 Guide Receiving an income tax notice can feel stressful, but in most cases, it is easy to handle if you respond correctly and on time. The Income Tax Department issues notices for many reasons—mistakes in filing, mismatched data, high-value transactions,

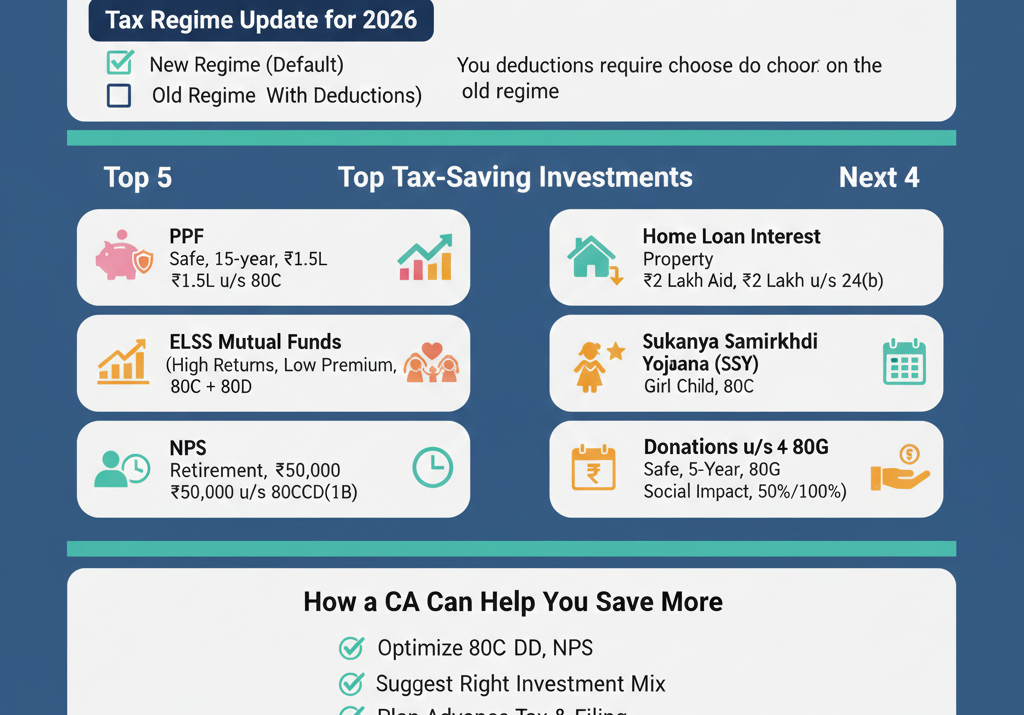

Best Tax-Saving Investments for FY 2026–27 (CA Recommended Guide) Every year, taxpayers look for smarter ways to save tax while building long-term wealth. With new financial products, updated tax rules, and rising inflation, choosing the right tax-saving options in 2026–27 is more important than ever. This updated guide explains the best tax-saving investments, who should