Income Tax Return Filing Checklist for AY 2026–27 (Avoid These Common Mistakes) Filing your Income Tax Return (ITR) for AY 2026–27 is not just about submitting a form. A small mistake can lead to refund delays, notices, or penalties. This complete checklist will help salaried individuals, self-employed professionals, and small business owners file their ITR

Union Budget 2026: What Changed for Salaried, Self-Employed & Small Business Owners? Union Budget 2026 has introduced several important changes impacting salaried employees, self-employed professionals, and small business owners in India. While the government’s focus remains on simplification, compliance, and middle-class relief, the actual benefit depends on how your income is structured. In this detailed

The ₹25 Lakh Leave Encashment Leap: More Than Just a Budget Update Author: CA Shiwali DagarPublished: January 2026 Introduction For over two decades, the exemption limit for leave encashment under Section 10(10AA)(ii) remained frozen at ₹3,00,000. While salaries of government employees increased substantially through successive Pay Commissions, the corresponding exemption for non-government employees failed to

Chartered Accountant in Hauz Khas, South Delhi – Tax, GST & Compliance | CA Shiwali Looking for a reliable Chartered Accountant in Hauz Khas, South Delhi? CA Shiwali provides expert Income Tax, GST, Audit & Compliance services to professionals, startups, freelancers, doctors, traders, and businesses in Hauz Khas and nearby areas. ✔ ICAI Registered Chartered

Salary ₹50,000? Here’s How Smart Indians Are Saving ₹1 Lakh Tax Legally in 2026 By CA Shiwali | Cashiwali.com Earning ₹50,000 per month (₹6 lakh per year) and still paying unnecessary tax?You’re not alone. In 2026, thousands of salaried Indians overpay tax simply because they don’t plan correctly. The truth is—legal tax saving is possible

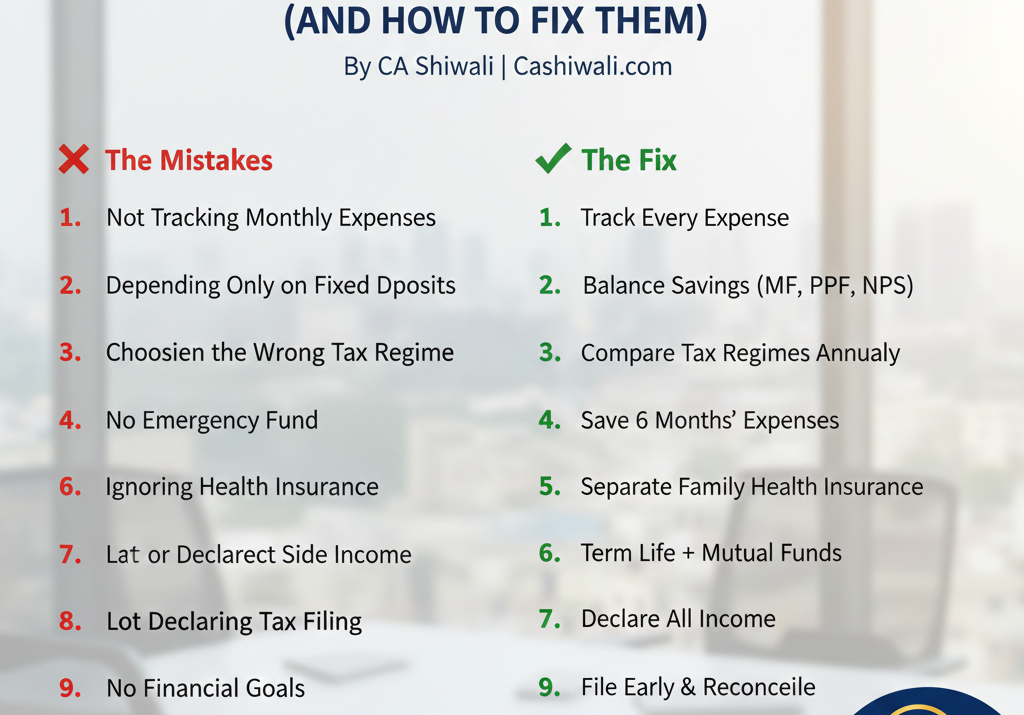

10 Money Mistakes Indian Families Still Make in 2026 (And How to Fix Them) By CA Shiwali | Cashiwali.com Managing money has become more complex in 2026. Despite higher incomes, better apps, and more awareness, many Indian families still struggle financially—not because they earn less, but because they make avoidable money mistakes. As a practicing