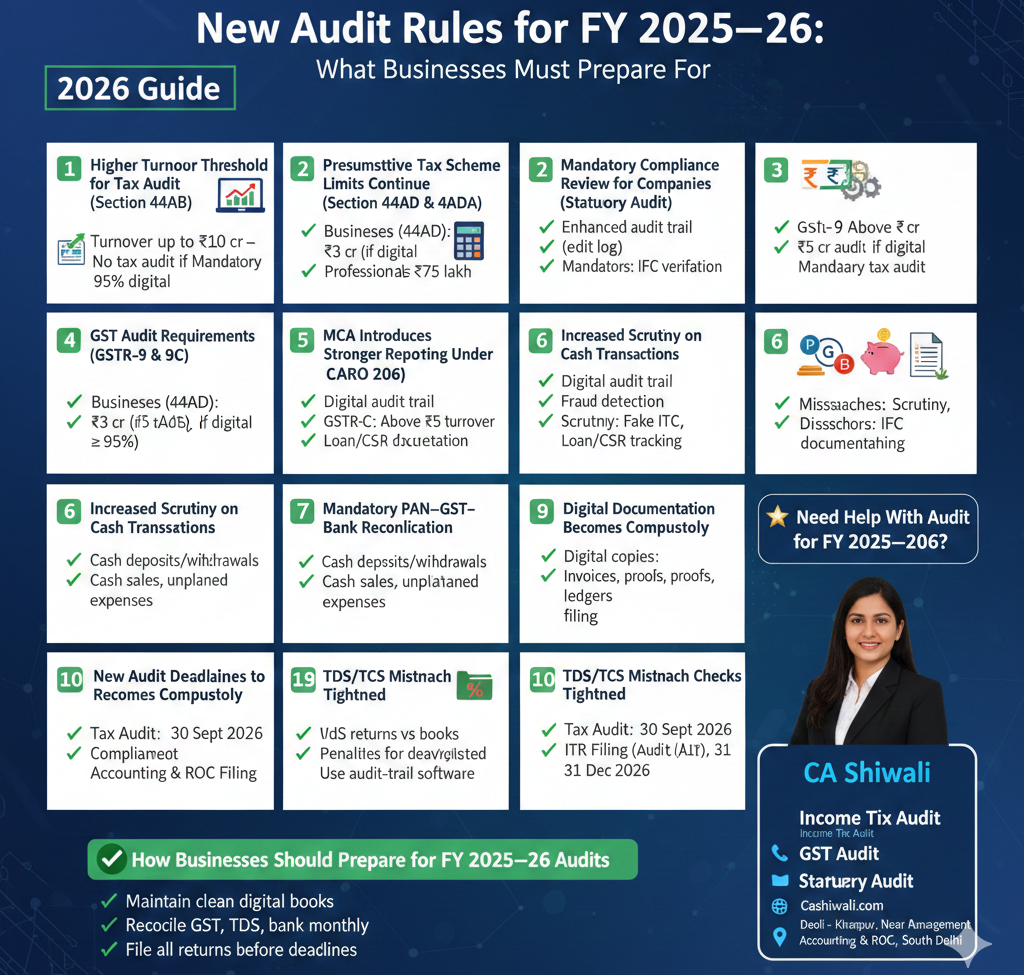

New Audit Rules for FY 2025–26: What Businesses Must Prepare For (2026 Guide)

New Audit Rules for FY 2025–26: What Businesses Must Prepare For (2026 Guide)

The financial year 2025–26 brings several important audit-related changes that every business—whether a proprietorship, partnership, LLP, startup, or private limited company—must understand. These updates impact tax audits, statutory audits, GST audits, compliance timelines, and digital reporting standards.

If you run a business in India, these changes can directly affect your audit eligibility, compliance costs, filing process, and documentation requirements.

This guide will help you understand the latest audit rules for FY 2025–26 and how to stay fully compliant.

1️⃣ Higher Turnover Threshold for Tax Audit (Section 44AB)

The tax audit limit continues to follow the updated, turnover-based digital transaction rules:

✔ Turnover up to ₹10 crore – No tax audit required if at least 95% of transactions are digital.

✔ Turnover above ₹10 crore – Tax audit becomes mandatory.

This encourages businesses to adopt digital payments, online invoices, and traceable financial records.

Who should prepare?

Businesses still using cash receipts/payments must reduce cash dependency to avoid mandatory audit.

2️⃣ Presumptive Tax Scheme Limits Continue (Section 44AD & 44ADA)

For FY 2025–26:

-

Businesses under Section 44AD: Limit continues at ₹3 crore (if digital transactions ≥ 95%).

-

Professionals under Section 44ADA: Limit continues at ₹75 lakh.

If your turnover/professional income exceeds these limits, a tax audit becomes compulsory.

3️⃣ Mandatory Compliance Review for Companies (Statutory Audit)

Every private limited company, regardless of turnover, must undergo a statutory audit.

New requirements for FY 2025–26:

-

Enhanced audit trail (edit log) in accounting software—cannot be disabled.

-

Mandatory UDIN verification for all audit reports.

-

Directors must ensure internal financial controls (IFC) documentation is updated.

Auditors will check if companies follow the new digital audit trail rule implemented by MCA.

4️⃣ GST Audit Requirements (GSTR-9 & 9C)

While GST audit by a CA is no longer compulsory for all businesses, some compliance rules remain:

-

Annual Return (GSTR-9): Mandatory for businesses above ₹2 crore turnover.

-

Reconciliation Statement (GSTR-9C): Required for turnover above ₹5 crore.

The government has increased scrutiny on:

✔ fake ITC

✔ mismatched GSTR-2B vs GSTR-3B

✔ under-reported outward supplies

Expect more notices and reconciliation checks in FY 2025–26.

5️⃣ MCA Introduces Stronger Reporting Under CARO 2026

CARO (Companies Auditor’s Report Order) gets tighter in FY 2025–26. Auditors must now comment on:

-

Proper maintenance of books with digital audit trail

-

Fraud detection & reporting

-

Loan/advance tracking

-

CSR spending compliance

-

Inventory control systems

Companies should prepare well-maintained accounting records to avoid audit qualifications.

6️⃣ Increased Scrutiny on Cash Transactions

ITD and GST departments are monitoring:

-

Cash deposits

-

Cash withdrawals

-

Cash sales

-

Unexplained expenses

Businesses with cash-heavy operations may face audit red flags.

7️⃣ Mandatory PAN–GST–Bank Reconciliation

For FY 2025–26, businesses must keep records that match across:

-

Income tax data

-

GST returns

-

Bank statements

-

Books of accounts

Mismatches may trigger:

✔ GST audit notice

✔ Income tax scrutiny

✔ ITC denial

8️⃣ Digital Documentation Becomes Compulsory

Auditors will require digital copies of:

-

Invoices

-

Payment proofs

-

Bank statements

-

Ledgers

-

Purchase orders

-

Expense records

Businesses still using manual files should switch to digital record-keeping immediately.

9️⃣ TDS/TCS Mismatch Checks Tightened

Auditors will verify:

-

TDS returns vs books

-

TCS on e-commerce sales

-

Delayed TDS deposit penalties

Incorrect or late TDS filing may lead to interest, penalties, and audit remarks.

🔟 New Audit Deadlines to Remember for FY 2025–26

-

Tax Audit Last Date:

30 September 2026 -

ITR Filing for Audit Cases:

31 October 2026 -

Statutory Audit (Companies):

Within 6 months of financial year end -

GST Annual Return:

31 December 2026

Missing deadlines may attract penalties from Income Tax, GST, and MCA.

🟢 How Businesses Should Prepare for FY 2025–26 Audits

✔ Maintain clean digital books

✔ Reconcile GST, TDS, and bank records monthly

✔ Keep vendor invoices and expense proofs ready

✔ Reduce cash transactions

✔ Use audit-trail-enabled accounting software

✔ File all returns before deadlines

⭐ Need Help With Audit for FY 2025–26?

CA Shiwali provides:

-

Income Tax Audit

-

GST Audit

-

Statutory Audit for Companies

-

Compliance Management

-

Notice Handling

-

Accounting & ROC Filings

📞 9266032777

🌐 www.Cashiwali.com

📍 Deoli – Khanpur, Near Saket, South Delhi