⭐ How to Respond to an Income Tax Notice in India — A Complete 2026 Guide

Receiving an income tax notice can feel stressful, but in most cases, it is easy to handle if you respond correctly and on time. The Income Tax Department issues notices for many reasons—mistakes in filing, mismatched data, high-value transactions, or missing documentation.

Here is a simple, step-by-step guide for 2026 to help you understand and reply to Income Tax Notices without panic.

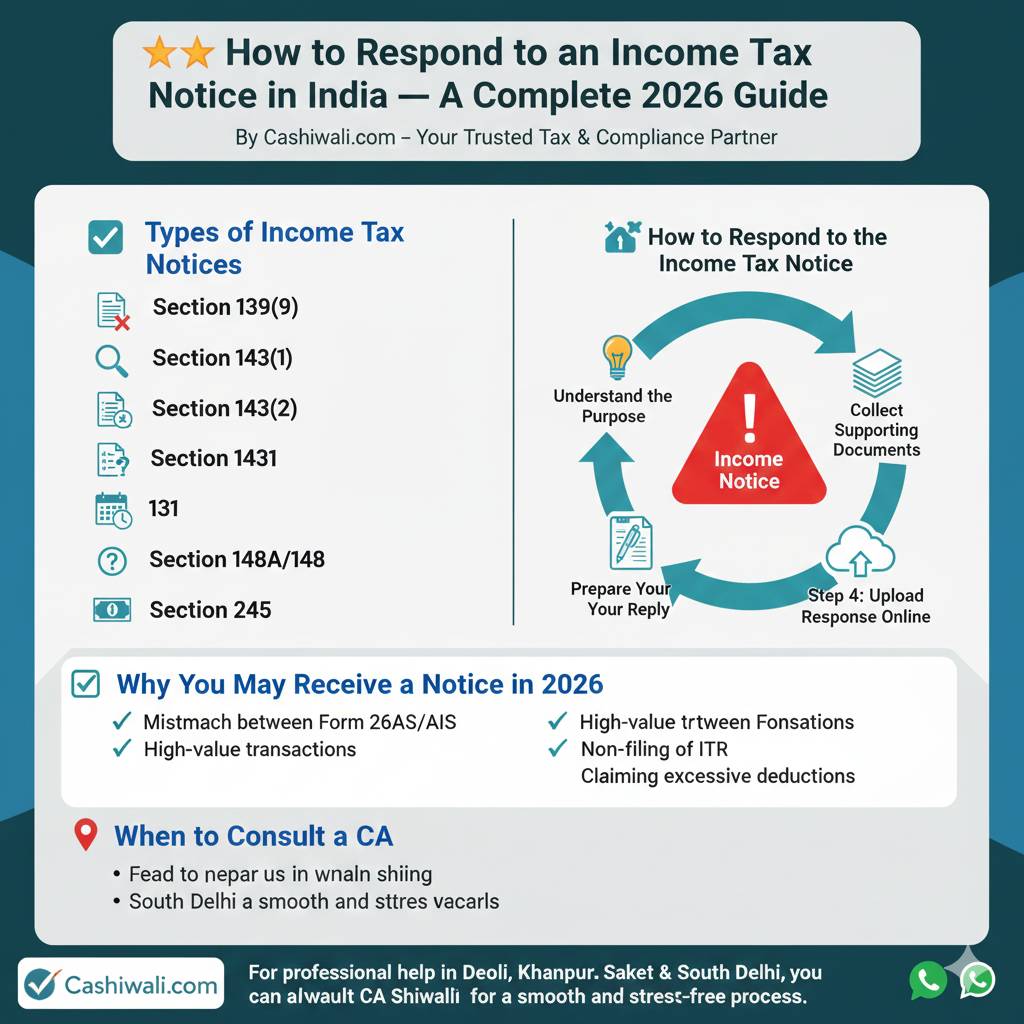

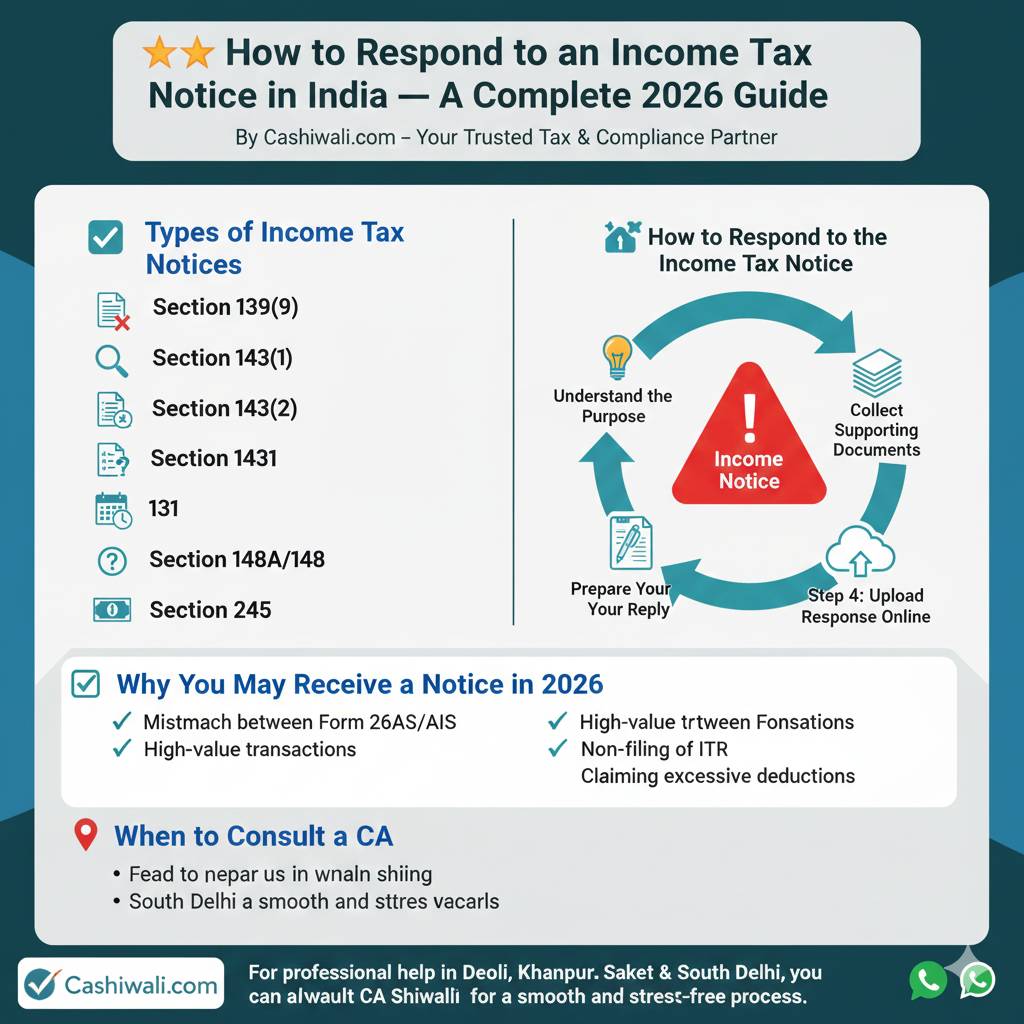

✅ Types of Income Tax Notices You May Receive

1. Section 139(9) – Defective Return Notice

This is sent when your ITR has an error, missing schedule, or incomplete information.

2. Section 143(1) – Intimation Notice

The department compares your filed return with their data.

You may get:

No change

Refund

Demand (if tax payable)

3. Section 143(2) – Scrutiny Notice

Issued when your case is selected for detailed scrutiny. Documents will be required.

4. Section 131 – Income Investigation

Department requests proof of income, investments, loans, or expenses.

5. Section 148A/148 – Reassessment Notice

Sent if income is suspected to be underreported or escaped earlier assessment.

6. Section 245 – Adjust Outstanding Demand

Used when the department wants to adjust a pending refund with past tax dues.

📝 Why You May Receive a Notice in 2026

Common triggers include:

Mismatch between Form 26AS/AIS and ITR

High-value cash deposits or investments

Non-filing of ITR despite taxable income

Claiming excessive deductions

Property purchase/sale without proper reporting

Incorrect TDS details

🔧 How to Check Your Notice Online (2026 Update)

Visit the Income Tax e-Filing Portal

Login using your PAN & password

Go to Pending Actions → Notices

Download and read the notice carefully

Note the section, reason, and deadline

🛠️ How to Respond to the Income Tax Notice

Step 1: Understand the Purpose

Check which section the notice falls under. This decides whether you must revise your return, upload documents, or simply respond with clarification.

Step 2: Collect Supporting Documents

Depending on the notice, keep ready:

Form 16

Form 26AS / AIS

Bank statements

Investment proofs

Purchase/sale documents

Business books of accounts

Step 3: Prepare Your Reply

Ensure your reply addresses each point raised. Avoid unnecessary details.

Step 4: Upload Response Online

Submit through:

e-Proceedings → Submit Response

Attach documents in PDF format.

Step 5: Acknowledge and Save Proof

Download the acknowledgment for your records.

🧾 Common Mistakes to Avoid in 2026

Ignoring the notice

Uploading unclear documents

Giving incomplete explanations

Missing the deadline

Filing wrong revised returns without reviewing AIS/26AS

📌 When to Consult a CA (Highly Recommended)

You should take help from a Chartered Accountant when:

You receive a Scrutiny Notice (143(2))

Your case involves business income

You need to prepare books, proofs, or clarifications

You receive a Section 148/148A notice

A CA ensures the reply is accurate and reduces future complications.

🎯 Final Takeaway

Income tax notices are common and often routine.

Respond truthfully, promptly, and with proper documents—you’ll be safe.

For professional help in Deoli, Khanpur, Saket & South Delhi, you can always consult CA Shiwali for a smooth and stress-free process.